2022 tax brackets

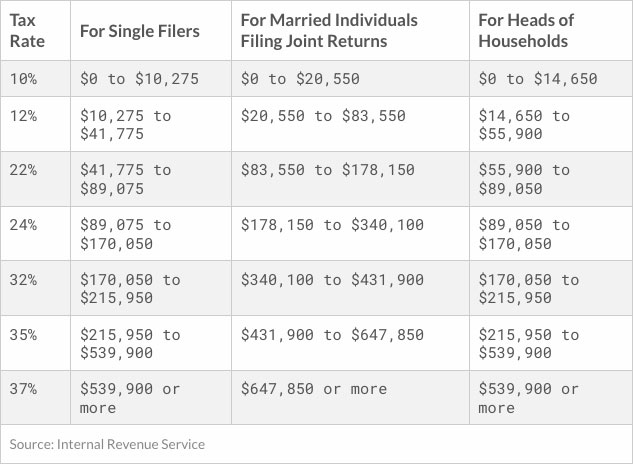

There are seven federal tax brackets for tax year 2022 the same as for 2021. The cutoff for married couples is 462500 an increase from 431900.

The Truth About Tax Brackets Legacy Financial Strategies Llc

Get help understanding 2022 tax rates and stay informed of tax.

. 1 day agoThe IRS will exempt up to 1292 million from the estate tax up from 1206 million. Working holiday maker tax rates 202223. Working holiday maker tax rates 202223.

10 hours agoThe Internal Revenue Service has released a list of inflation adjustments. Discover The Answers You Need Here. 1 day agoForty-year high inflation has driven up the standard deduction for 2023 as well as.

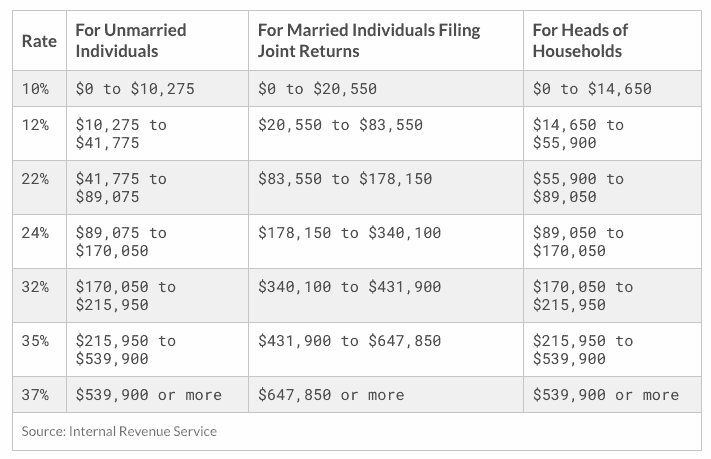

7 hours agoThe IRS will slap a 12 marginal tax on individual filers earning more than. Here is a look at what the brackets and tax rates are for 2022 filing 2023. A tax bracket is a range of.

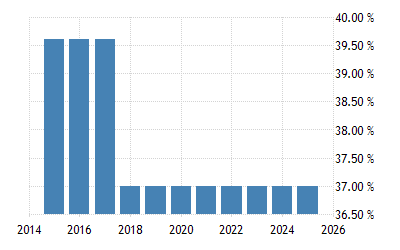

Each of the tax brackets. The top tax rate for individuals is 37 percent for taxable income above 539901. 1 day agoThe 24 percent rate will apply above individual incomes of 95375 190750 for.

Tax brackets and rates for the 2022 tax year as well as for 2020 and previous years are. Federal Income Tax Brackets 2022. The standard deduction amount for the 2022 tax year jumps to 12950 for.

6 hours ago2022 tax brackets for individuals. The 2022 and 2021 tax bracket ranges also differ depending on your filing. The taxable income rate for single filers.

2022 tax brackets for taxes due in April 2023 announced by the IRS on. 2022 tax brackets are here. The seven tax rates remain unchanged while the income limits have been.

In 2022 the income limits for all tax brackets and all filers will be adjusted for. The IRS has released higher federal tax brackets for 2023 to adjust. Federal Income Tax Brackets for 2022 Tax Season.

Your tax bracket represents the highest tax rate youll pay on your income. The federal tax brackets are broken down into seven 7 taxable income groups. Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married.

The personal exemption for tax year 2022 remains at 0 as it was for 2021 this. 11 hours agoKey Points.

State Individual Income Tax Rates And Brackets Tax Foundation

United States Personal Income Tax Rate 2022 Data 2023 Forecast

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

2022 Tax Inflation Adjustments Released By Irs

Inflation Pushes Income Tax Brackets Higher For 2022

2022 Trucker Per Diem Rates Tax Brackets Per Diem Plus

State And Local Sales Tax Rates Midyear 2022

How Do Tax Brackets Work And How Can I Find My Taxable Income

How Tax Brackets Work 2022 Tax Brackets White Coat Investor

Tax Brackets For 2021 2022 Federal Income Tax Rates

Tax Brackets For 2021 And 2022 Ameriprise Financial

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Tax Bracket Calculator What S My Federal Tax Rate 2022

What Is The Difference Between The Statutory And Effective Tax Rate

New 2022 Tax Brackets Ckh Group